Call: (619) 287-8613

The products/plans advertised herein are not sponsored, approved, or endorsed by, or otherwise affiliated with, Farmers Group, Inc.

Ignore Farmers’ April 25th Email on the Impacts of Category One Claims at Your Own Risk

Stay Informed or Risk Your Agency's Future

SEPTEMBER 6, 2023 - CATEGORY ONE , GROUP E&O - BY KEVIN DAHLKE

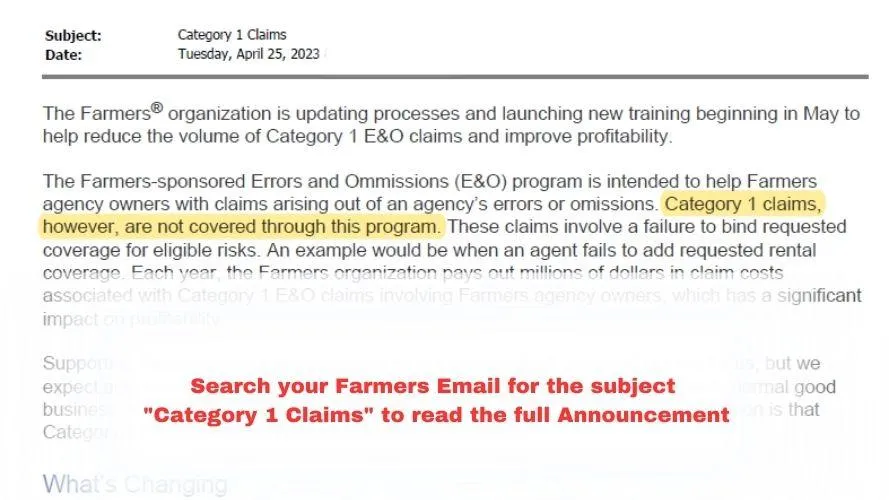

Regarding the Farmers’ April 2023 memo on Category One claims, we’ve been flooded with questions from agents seeking clarity. So, let’s dispel the fog.

Let’s be clear: Category One claims are tied strictly to Farmers’ policies, not your outside business. In addition, this stipulation spans all E&O coverage levels available through the Farmers Sponsored E&O Plan.

Farmers delivered a reality check in their email: when you issue a Farmers policy, your Farmers Sponsored Group E&O Plan offers zero coverage for Category 1 claims. This glaring omission could leave your agency teetering on the brink of an uncovered E&O claim. Don’t let oversight, apathy, or misplaced faith in a large corporation spell the end of your agency.

Imagine this scenario:

You sell a Farmers HO policy with a 300K CPL limit. The client suffers a 500K loss and sues. The insured was eligible for higher coverage, but no record of such a request exists. As a result, you face an E&O claim.

Under the Farmers Sponsored E&O plan, such claims are explicitly excluded. Therefore, to secure coverage at Farmers’ discretion for an insured claim, you must now show that the insured requested the coverage and that you tried to provide it. Failure to produce such proof may lead to Farmers denying your E&O claim, potentially leaving your agency without E&O coverage.

Unfortunately, we have documented cases where agents had their E&O claims excluded, and Farmers refused to provide coverage (documentation of excluded agent claims is available). So, you see, it is not an insurance contract you have in this situation; it is Farmer’s unwritten and non-guaranteed assertion that they will review and possibly pay your claim.

Just as you wouldn’t sell a policy to your clients that excludes the primary reason they seek coverage, it’s essential not to accept such limitations for your agency’s protection. Understanding the Category 1 Exclusion you currently suffer from is necessary to safeguard your agency.

So, what can you do since it is not the enrollment period, and you may believe you must buy your coverage from the Farmers sponsored plan?

Your coverage is monthly by Farmer’s design to allow agents to enter and exit Farmers throughout the year without a short rate cancellation process. You can change at any time without penalty.

You are not required to buy from Farmers, so Farmers created the forms for an agent to opt for other plans (which we provide to you along with the instructions). However, most agents have misconceptions about their Farmers Sponsored E&O plan because little information about the plan rules is readily available, such as how to cancel, your reduction of benefits due to termination type with Farmers, and, most importantly, that Farmers, at its discretion, can decline to cover your Category One claim. Bankruptcy may terminate your Farmer’s contract, and your policies go to a new agent. Most of you are appointed as sole proprietors, so your personal assets may be at risk.

Remember, what someone tells you is not proof. If you call to ask about this exclusion, specify you want it in writing that you have coverage for Category One claims. You will not get it because it does not exist.

By taking charge of your E&O with the GEO Advantage E&O Plan! here’s what you can expect:

Category 1 E&O Claims are treated just like any other claim.

Lower Premiums: Save an average of $500/year, and you may save more.

Expert Support: Our dedicated team with 42 years of agency operations experience, experience with Farmers, and 25 years of professional lines underwriting are always here to help you with exceptional service and guidance.

Begin the journey to protect your agency’s future with these easy steps:

Go to www.groupeando.com for a quick indication of the rate. When you submit the rate indication, it appears on the left, and the first year-only application’s first page is on the right. If you take a few moments to complete it for a firm quote.

Call Calsurance 866-893-1023 for your E&O loss history (even if you have no claims) to submit if you decide to bind coverage. They will email it in a couple of days.

Review the online quote provided and submit a binding request if it meets your approval. Then, you have plenty of time for the subsequent binding date of the first of the following month.

With our guidance, you’ll experience a seamless transition:

We’ll walk you through the Farmer’s cancellation process.

No upfront cost – your premium is only due after your policy’s effective date.

Since 2009, we have been assisting Farmer’s agents through this transition, our team is eager to help you unlock the benefits of the GEO Advantage E&O Plan! If you need more information, email [email protected] or call us at 619-287-8613.

Your Farmers Sponsored E&O coverage excludes your Category One claim, and if you don’t have the documentation Farmers requires to cover your claim, you have little recourse, which may be your agency’s end.

Some agents have lived to regret their decision to continue to insure with the Farmer’s Sponsored E&O plan.

Don’t let this vital opportunity slip away. Complete your application today and secure a brighter future for your agency!

Kevin Dahlke

GEO Advantage Plan Administrator

You can trust us. I have over 40 years experience in the insurance industry and was a second-generation captive agent for 12 years. Since 2009 I have dedicated my energy to helping captive Agents with better Protection. - Kevin Dahlke

NOTICE: The products/plans advertised herein are not sponsored, or endorsed by, or otherwise affiliated with, Farmers Group, Inc. No information from this site will be provided to Farmers.

Copyright © 2026 | Kevin Dahlke Insurance Brokerage, Inc. | CA#0H45061 | Privacy Policy & Terms of Use | Contact Us